Global energy demand is set to increase significantly in the coming decades, which is creating attractive investment opportunities across both the alternative energy landscape and the traditional energy value chain. This Knowledge Center will help you understand the implications and how investors can take advantage of emerging opportunities. Learn more by exploring our Insights.

Energizing the future

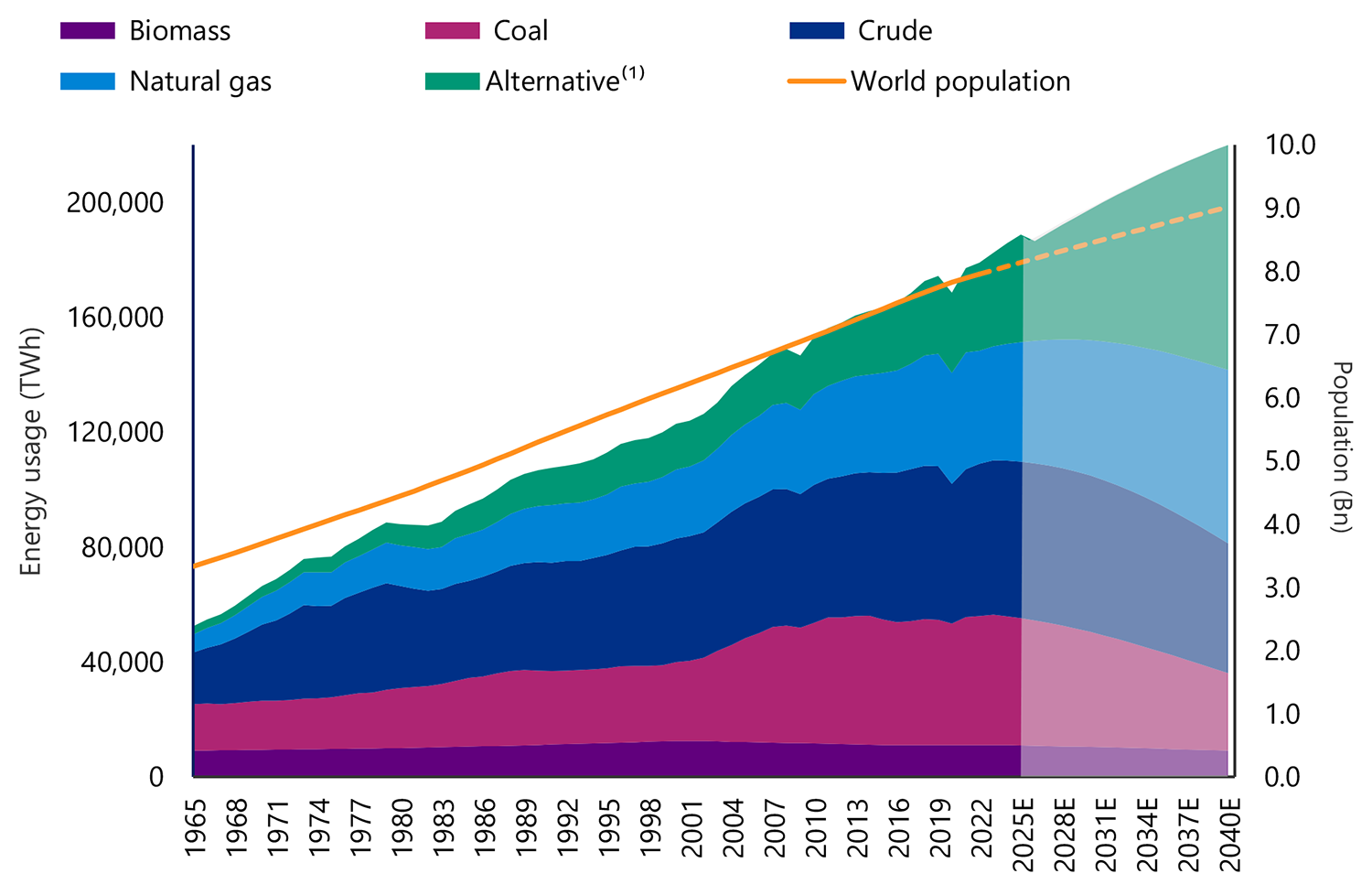

We believe global energy demand will grow annually through 2040, and beyond, due to both population and economic growth, which will result in global energy consumption reaching unprecedented levels in the coming years. Cohen & Steers believes the future of energy should be viewed through the lens of an “energy addition” rather than “energy transition”, as the world will need more of all types of energy (ex-coal) to satisfy demand.

Growing population means more energy needs

“Meeting 2040 energy estimates would require ~48,000 TWh(2) of alternative additions. This is roughly equivalent to the entire global oil industry as it stands today.”

– Benjamin Morton, Portfolio Manager

At December 31, 2023. Source: Our World in Data, Bloomberg and Cohen & Steers estimates

The views and opinions are as of the date of publication and are subject to change without notice. There is no guarantee that any market forecast set forth in this material will be realized.

(1) Alternative energy comprised of solar, wind, hydropower, nuclear and other renewable sources

(2) Terawatt-hour

We foresee economies becoming more energy efficient through utilization of new technologies. But even with increasing adoption of alternative energy sources, traditional energy is still projected to make up the majority of energy production through 2040. If the industry is to meet energy demand by 2040, record investments in energy must be made. Put simply, the marketplace requires all the reliable—and, ideally, clean—energy sources it can summon.

Alternatives set to spike

“Meeting projected 2040 energy estimates will require an additional spending of roughly $13.3 trillion.”

– Tyler Rosenlicht, Portfolio Manager

At December 31, 2023. Source: Our World in Data, Bloomberg and Cohen & Steers estimates.

The views and opinions are as of the date of publication and are subject to change without notice. There is no guarantee that any market forecast set forth in this material will be realized.

(1) Alternative energy comprised of solar, wind, hydropower, nuclear and other renewable sources.

(2) Terawatt-hour

Understanding an evolving energy landscape

The energy industry is undergoing significant transformation. While energy once focused predominately on fossil fuels, alternatives are now not only desired but will become essential in the coming decades.

Traditional energy is defined as the industries within Bloomberg Industry Classification Standard (BICS)(2) Oil & Gas sector.

Alternative energy is comprised of a broad array of industries within BICS(2) sectors such as Renewable Energy, Electric Utilities, and Engineering & Construction. There is no common, universally accepted definition of alternative energy.

At December 31, 2023. Source: Bloomberg and Cohen & Steers

There is no guarantee that any market forecast set forth in this material will be realized. There is no guarantee that any historical trend illustrated above will be repeated in the future, and there is no way to predict precisely when such a trend might begin.

(1) Alternative energy includes securities of renewable companies that are owners or operators of “clean” assets, as well as those developing technologies, products, processes and services relating to more efficient or cleaner use, storage, delivery, management, conservation or conversion of natural resources or products derived therefrom or the transition to cleaner and more efficient use of natural resources or products derived therefrom

(2) Bloomberg Industry Classification Standard

Evolution of energy markets is creating opportunity across both the traditional and alternative energy value chain

Investing in the overall energy picture

We believe superior outcomes can be achieved by combining traditional forms of energy, such as crude oil and natural gas, with alternatives, such as wind and solar. Most investment strategies currently invest in just one form of energy or the other, despite increased levels of volatility and varied performance profiles.

Since 2014, these two sectors have performed inversely (traditional up / alternative down and vice versa) in 6 of 10 periods. History shows that combining the two can potentially smooth volatility and create superior risk-adjusted returns.

Traditional and alternative energy returns routinely diverge

Blending traditional with alternative gives full access to the energy value chain

At August 31, 2023. Source: Morningstar.

Data quoted represents past performance, which is no guarantee of future results.

Featured Insights

Tyler Rosenlicht

Tyler Rosenlicht

Learn more

Connect with your Cohen & Steers team to learn more about opportunities in the energy sector and our new

Future of Energy Fund.

IN THE NEWS

News Coverage

Cohen & Steers’ Rosenlicht: Investors must look beyond alternative energy to smooth returnsInvestmentNews: Cohen & Steers strategist sheds new light on investing in energy sector

Watch videoPortfolio Manager Tyler Rosenlicht joined InvestmentNews’ IN the Nasdaq to discuss his outlook for the future of energy and why he believes existing investment strategies provide a limited view of the asset class. He discusses why global energy demand is driving the need for energy addition, requiring both traditional and alternative energy to satisfy this demand.

Towers and turbines: An infrastructure stimulus update

Watch videoWith the signing of the Infrastructure Investment and Jobs Act and an even larger package awaiting Senate approval, the U.S. is poised to make its largest investment in infrastructure since Eisenhower rolled out the interstate highway system in the 1950s.

Decarbonization opportunities within infrastructure

Watch videoThe energy transition away from fossil fuels towards renewable sources is not just making headlines. Investors are increasingly looking for ways to take advantage of something we see as a long-term trend.

InvestmentNews: Cohen & Steers strategist sheds new light on investing in energy sector

Portfolio Manager Tyler Rosenlicht joined InvestmentNews’ IN the Nasdaq to discuss his outlook for the future of energy and why he believes existing investment strategies provide a limited view of the asset class. He discusses why global energy demand is driving the need for energy addition, requiring both traditional and alternative energy to satisfy this demand.

Watch videoTowers and turbines: An infrastructure stimulus update

With the signing of the Infrastructure Investment and Jobs Act and an even larger package awaiting Senate approval, the U.S. is poised to make its largest investment in infrastructure since Eisenhower rolled out the interstate highway system in the 1950s.

Watch videoDecarbonization opportunities within infrastructure

The energy transition away from fossil fuels towards renewable sources is not just making headlines. Investors are increasingly looking for ways to take advantage of something we see as a long-term trend.

Watch videoIndex Definitions and Important Disclosures

The views and opinions are as of the date of publication and are subject to change without notice. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice, is not intended to predict or depict performance of any investment and does not constitute a recommendation or an offer for a particular security. We consider the information in this presentation to be accurate, but we do not represent that it is complete or should be relied upon as the sole source of suitability for investment. Please consult with your investment, tax or legal professional regarding your individual circumstances prior to investing.

S&P Energy Sector Index seeks to provide a representation of the energy sector of the S&P 500 Index. The Index includes companies from the following industries: oil, gas and consumable fuels; and energy equipment and services.

S&P Global Clean Energy Index measures the performance of 30 largest companies in global clean energy related businesses from both developed and emerging markets.

Please consider the investment objectives, risks, charges and expenses of the Fund carefully before investing. A summary prospectus and prospectus containing this and other information may be obtained by calling 1.800.330.7348 or visiting cohenandsteers.com. Please read the summary prospectus and prospectus carefully before investing.

Energy Important Risk Considerations: Investing involves risk, including entire loss of capital invested. There can be no assurance that the investment strategy will meet its investment objectives. Diversification is not guaranteed to ensure a profit or protect against loss. An investment in the energy sector involves risks that differ from a similar investment in equity securities, such as common stock, of a corporation. Investors will subject to more risks related to the energy sector than if the Fund were more broadly diversified over numerous sectors of the economy. A downturn in the energy sector of the economy could have a larger impact on the Fund than on an investment company that does not concentrate in the sector. At times, the performance of securities of companies in the sector has lagged the performance of other sectors or the broader market as a whole. Energy sector investments can be volatile due to fluctuations in commodity prices, availability of resources, slowdowns in construction, reduced demand for energy products, regulatory changes, extreme weather or natural disasters, rising interest rates and geopolitical events. Special risks of investing in foreign securities include (i) currency fluctuations, (ii) lower liquidity, (iii) political and economic uncertainties, and (iv) differences in accounting standards. Certain foreign securities may represent small- and medium-sized companies, which may be more susceptible to price volatility and less liquid than larger companies. The Fund is classified as a "non-diversified" fund under the federal securities laws because it can invest in fewer individual companies than a diversified fund. However, the Fund must meet certain diversification requirements under the U.S. tax laws.